How to Organize Important Documents, Part 1

Today’s post was inspired by my college-student son’s frantic search over the past three days for his W-2 forms. His tax returns have been complete for a couple of months and he is even getting a tax refund. But for whatever unfathomable reason, he elected to wait until this weekend to actually file. And then he couldn’t remember what he had done with his W-2 form.

Today’s post was inspired by my college-student son’s frantic search over the past three days for his W-2 forms. His tax returns have been complete for a couple of months and he is even getting a tax refund. But for whatever unfathomable reason, he elected to wait until this weekend to actually file. And then he couldn’t remember what he had done with his W-2 form.

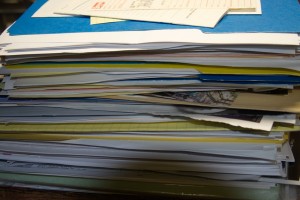

Document storage seems to be most people’s biggest clutter issue. Actually, figuring out what to do with paper of any kind seems to make the top of just about everyone’s clutter lists. I consider myself a relatively organized person, but I have to admit, I HATE filing. As a result, my “to file” bin usually ends up overflowing before I schlep it down to the dungeon where I keep the file cabinets (yes, it is plural). I have two four-drawer file cabinets: one has always been for family documents and the other is a relic from my studio days. Since I only actually use four drawers for document storage, I could probably get rid of one but that would mean dragging it up from the dungeon and I don’t see anyone at my house volunteering for the task so it’s probably down there for good. Maybe I’ll even leave it when someday it’s time to move again. And, no, we’re not going to get into what lives in the other four drawers, but they really do have a purpose and are clean and tidy—well, except maybe the one on them bottom, but I’m not going down to look, so. . . .

But I digress. Let’s get back to figuring out what to do with all that paperwork piled up from tax season.

Contrary to popular belief, you do not need a file cabinet to organize important documents. There are many different filing methods and what you choose will depend on how much space you have, how much you have to store and your lifestyle. You can use a filing cabinet, a file box, accordion folders, envelopes or whatever else works for you. If you really have lots of time, you can even digitize everything and store it online, though it is best to keep paper copies of really important documents. Before deciding on the best storage method, you need to know what you are storing.

The first step in eliminating the paper clutter is just that: Elimination. I recommend you clear a large workspace. You can use the dining room table, the kitchen counter (just make sure it’s clean and dry) or even the living room floor. If you have a lot of papers to sort through, it may take you more than one day, so you might not want to use your bed—or the kitchen counter—as a sorting surface. You also need a trash or recycling bin and a “to shred” bin. Some papers can just be tossed but some will need to be shredded.

Decide on some filing categories for your paperwork. You’ll probably begin refining them after you do your initial sort, but for now general categories will do. Trying to refine it too much is going to make this task more overwhelming than you already think it is. To start, take several blank sheets of paper and give each one a category name and arrange them on your work surface. I suggest starting with these categories: tax-related, insurance, vital records, employment, education, finance, medical records, warranties & instruction booklets. You might also have additional categories such as recipes, correspondence or photographs.

Now that you are all set, grab that first stack of papers and let’s sort. Go through your stack and place each document on top of the appropriately named paper. As you sort, throw away trash such as envelopes, scratch paper, old grocery lists and all those magazine clippings full of “really good ideas” that you’ve never done anything with. They can easily be replaced with your Pinterest account for a lot less space. But don’t start on Pinterest until your done with sorting or these piles will still be here next tax season.

Once you have sorted through every pile of paper you have strategically placed all over the house (I bet you’d forgotten the desk was that color, didn’t you?)—and don’t forget your purse or briefcase, you are ready to move on to step two. You are probably also ready for a break because if you’re like me, having to look at that much boring paperwork pretty much makes your eyes cross and your head hurt.

So, today I will finish off this post with some recommendations on what to keep and how long to keep it. In my next organizing post, I’ll help you sort through those piles and figure out how to get it all filed so you can actually find something when you need it.

Documents |

How Long to Keep Them |

| Completed Tax Returns, W-2, 1099, etc (IRS forms) | At least 7 years, most accountants recommend keeping these permanently |

| Documents used in filing your tax returns, business receipts, charitable donation records, mortgage interest, retirement plans, records for tax deductions taken | 7 years. The IRS has 3 years from your filing date to audit good-faith returns & up to six years to challenge a return if it thinks you underreported your gross income by 25% or more. There is no time limit if you file fraudulently or fail to file. |

| IRA/Retirement fund contribution records | Permanently—keep the quarterly statements until you receive the annual one. Then you only need to keep the annual report if everything adds up properly. |

| Bank Statements | Keep anything needed for business documentation, tax purposes or to document home improvements. Non-essential documents can be disposed of after one year. |

| Brokerage statements | Keep as long as you own the securities. |

| Bills & Receipts | Keep anything needed to document large purchases or for warranty purposes for as long as you own the item. These can help prove value in the event of an insurance claim or the need for warranty service. Dispose of non-essential bill records once you have verified that the bill has been paid. |

| Credit card receipts & statements | Keep your credit card receipts until you get your monthly statement to make sure everything matches up. Keep any receipts needed for tax purposes and dispose of the rest. |

| Paycheck Stubs | Keep each year’s pay stubs until you receive your W-2 to make sure the information matches. If it matches, dispose of your pay stubs. If it doesn’t you’ll want to request a corrected W-2 from your employer. |

| Home or Vehicle Ownership Records | Keep them as long as you own the home or vehicle. This should include records of permanent home improvements and major repairs, and everything related to buying or selling the property. You should also keep vehicle maintenance records as long as you own your vehicle. |

| Insurance Documents | Keep as long as the policy is in force or you have unresolved claims. It is recommended that you keep a copy of the policy for up to seven years (your agent is required to keep a copy of your expired policy for up to seven years depending on the state). If you have medical expenses that will affect your tax returns, keep those for as long as you would other tax-related documents. |

| Medical Records | Permanently. These would be treatment records, diagnoses, etc., not necessarily bills and Insurance benefit statements (see above). |

| Vital Records—wills, birth certificates, adoption decrees, marriage license, divorce decrees, diplomas, degrees and professional licenses | These should be kept permanently and in a safe place, such as a fireproof safe. |

Oh, and those W-2 forms my son couldn’t find? They were in the To-File bin (where I told him to look, but he didn’t) in a manila envelope neatly labeled “2011 Tax Returns.”

Don’t forget—next week I’ll be walking you through what to do with all those neatly sorted piles you have so you can get all that paper clutter organized and out of site before next tax season.

How do you manage your paper? What do you most need help with? Please share your questions, comments and feedback in the comment section below.

And please use the buttons below to share this with your network.

Great information! I have just finished going through all of my closets and cabinets reorganizing since my daughter got married and moved out. I am down to a small mountain of paper work and this will be a great help in getting it all taken care of. Thank you!

You are so welcome. I am so glad you found this helpful, Randi.

Thanks for this, Marie! I need to do a complete reorganization of the paper (that seems to breed) on my desk!!

Absolutely perfect advice. I need to get on this. You should see the beautiful unit in the front of our house that has become a catch all!

Thanks for the great advice.

I’m bookmarking this, as I read the first paragraph, right away I thought, “I never know how long Im suppose to keep certain documents, etc.” =) GREAT informative piece!

Perfect timing as mine is sitting in a pile. I have the piles sorted and filed sort of… 🙂 I so appreciate this! Now to find the time to do it!

Great timing on this one…no coincidence. I have pinned this so others can benefit from your son’s story.

I appreciated all those guidelines for how long to keep everything. I’m fairly good at filing things away, but sometimes I’ll go through the files and wonder if I really need to keep all that stuff! Great post!

These are really helpful tips Marie. I have a couple of those piles on my spare desk right now just waiting to be sorted. Thankfully the taxes are all done for this year though, with a minimum of fuss and panic. 🙂

Marie,

GREAT post with an AWESOME list of tips and information on organizing of everyone’s documents. THANKS for this!